The world of stock trading has always been a rollercoaster ride, with ups and downs that can make or break fortunes. However, no recent phenomenon has captured the attention of the investing community quite like the rise and fall of GameStop Corporation (GME) stock. It all began as a David vs Goliath story, with small-time investors banding together to stick it to Wall Street elites. But what caused this unprecedented surge in popularity? And why did it ultimately end in such a spectacular fashion? In this deep dive, we’ll explore the fascinating journey of GME stock – from its humble beginnings to its meteoric rise and eventual downfall.

GME Background

GameStop Corporation, or GME, is a US-based video game retailer that was founded in 1984. For many years, it was a well-known brand among gamers and investors alike. However, as the digital revolution took hold and more people began purchasing games online rather than at brick-and-mortar stores like GameStop, the company’s fortunes began to decline.

In recent years, GameStop has struggled with declining sales and mounting losses. This led to some hedge funds shorting the stock – essentially betting that its value would continue to decrease over time. But then something unexpected happened: a group of retail investors on Reddit’s WallStreetBets forum decided to band together and buy up shares of GME en masse.

This movement quickly gained steam as more people joined in on the action – driving up the price of GME from around $20 per share in early January 2021 to an all-time high of over $347 per share later that same month. This sudden surge caught many institutional investors off-guard and caused panic among those who had bet against GME.

Despite warnings from financial experts about the potential risks involved with investing in such a volatile stock, many small-time investors continued to pour their money into GME – hoping for another big payout like they had seen during previous surges in value.

GME’s Recent Performance

The recent performance of GME stock has been nothing short of incredible, capturing the attention of the entire financial world. In January 2021, the stock experienced an unprecedented surge, reaching a peak value of over $347 per share.

This sudden rise in value was largely due to a group of retail investors on Reddit’s WallStreetBets forum who encouraged others to buy and hold GME stock as a way to push back against institutional investors who had bet heavily against it.

However, this bubble burst just as quickly as it formed. The stock plummeted as soon as trading restrictions were introduced by online brokers such as Robinhood, limiting transactions for certain stocks including GME. This led many retail investors to sell their shares while they still held some value.

Despite these recent fluctuations in price, there are still those who believe that GME could experience another surge in the future. Some analysts point out that with new leadership at GameStop and potential partnerships with major tech companies like Microsoft and Sony, there is room for growth.

Only time will tell whether or not these predictions come true and if GME can continue its rollercoaster ride in the market.

GME’s Outlook

GME’s Outlook:

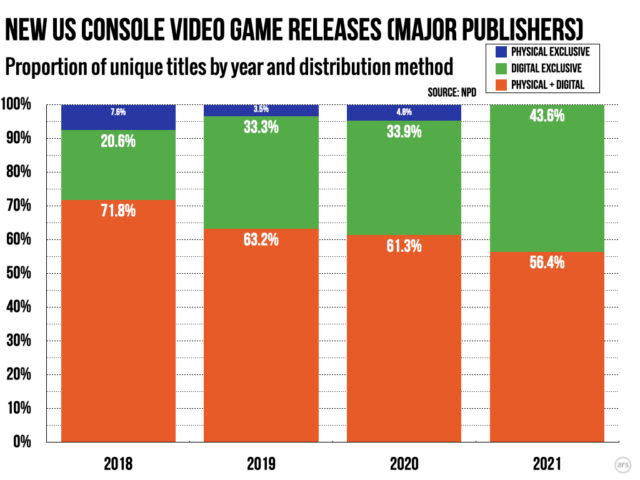

The outlook for GME stock remains uncertain, as the company continues to face numerous challenges. One of the main factors affecting its future prospects is the ongoing shift towards digital gaming platforms, which has led to a decline in demand for physical game discs and consoles.

Another key challenge facing GME is increased competition from other retailers, particularly online sellers such as Amazon and Walmart. These companies are able to offer lower prices and a wider selection of products than traditional brick-and-mortar stores like GameStop.

Despite these obstacles, there are some potential opportunities that could help boost GME’s future performance. For example, the recent launch of new gaming consoles from Sony and Microsoft may lead to increased sales of hardware and software at GameStop locations.

Additionally, some investors remain optimistic about GameStop’s ability to adapt to changing market conditions by expanding into new areas such as e-sports or offering more exclusive merchandise options.

While GME faces significant hurdles in the years ahead, it also has several potential avenues for growth that could help drive its stock price higher over time.

Factors that may Affect GME Stock

GME’s recent surge and fall in stock prices have been the talk of the town. However, there are several factors that may affect GME stock in the future. One major factor is the ongoing pandemic and its impact on consumer behavior.

With social distancing measures in place, people have been resorting to online shopping for their gaming needs. This has led to an increase in demand for digital games and consoles, which may negatively affect GME’s physical game sales.

Another factor that could impact GME’s stock price is competition from other retailers such as Amazon and Best Buy. These companies already offer a wider range of products at lower prices than GameStop can offer. As these larger retailers continue to dominate the market, it will be hard for GameStop to keep up.

Changes in technology can also play a role in shaping GME’s future performance. The rise of cloud gaming services like Google Stadia and Microsoft xCloud could lead to a decline in demand for physical copies of video games altogether.

While there are many factors that may influence GME’s stock price going forward, one thing remains clear: investors need to stay informed about industry trends if they want to make smart investment decisions related to this volatile market sector.

Conclusion

The rise and fall of GME stock has been a fascinating phenomenon that took the world by surprise. It was a story of how retail investors could band together to take on Wall Street giants.

While the battle may have seemed like a win for some, it is essential to remember that investing comes with significant risks. The volatility seen in GME’s recent performance serves as an important reminder of how quickly things can change in the stock market.

Moving forward, factors such as company earnings reports, regulatory changes, and investor sentiment will continue to affect GME’s stock price. It remains unclear whether or not GME will experience another meteoric rise like what we saw earlier this year.

Regardless of what happens next for GameStop, one thing is clear: its story has already left an indelible mark on Wall Street history books. Time will tell if this chapter is just the beginning or only a footnote in the annals of finance.